Introduction

XAUUSD, the trading pair representing gold against the US dollar, is known for its volatility and safe-haven status. Choosing the right indicator for XAUUSD can help traders identify trends, reversals, and optimal entry and exit points in this dynamic market. This article highlights the most effective indicators for trading XAUUSD, exploring verified data and trader insights to determine which tools offer the highest success rates.

Top Indicators for XAUUSD Trading

Due to gold’s unique price behavior, spot indicators for XAUUSD typically focus on trend direction, volatility, and momentum. Popular indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Bollinger Bands, Fibonacci retracement, and Average True Range (ATR) have been widely used for their effectiveness in gold trading. Each indicator provides a specific type of insight that helps traders navigate the highs and lows of XAUUSD.

1. Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of XAUUSD price movements, indicating overbought and oversold conditions. RSI values above 70 generally signal that XAUUSD may be overbought, while values below 30 suggest that it may be oversold.

Application in XAUUSD: In XAUUSD trading, RSI is particularly useful for identifying potential reversals during volatile periods. Traders use RSI to capture short-term trends and intraday shifts, helping to time entry and exit points accurately.

Trader Feedback: RSI is popular among traders for its simplicity and effectiveness in highlighting overbought and oversold conditions. Feedback indicates that RSI, especially when used with a trend indicator like the moving average, enhances decision-making by reducing false signals during volatile market movements.

2. Moving Average Convergence Divergence (MACD)

MACD is a trend-following indicator that highlights changes in the strength, direction, momentum, and duration of XAUUSD price trends. It is calculated by subtracting the 26-period EMA from the 12-period EMA, with the result compared to a 9-period signal line.

Utility in XAUUSD: Traders rely on MACD to identify bullish and bearish trends in XAUUSD, with crossovers above the signal line often seen as buy signals and crossovers below as sell signals. MACD is effective for medium-term trend identification, helping traders capitalize on prolonged movements in XAUUSD.

Performance Feedback: MACD’s ability to capture momentum shifts is highly valued in the XAUUSD market. Traders report that combining MACD with support and resistance levels improves accuracy, providing a clearer view of market direction and reducing the likelihood of false signals.

3. Bollinger Bands

Bollinger Bands are volatility indicators consisting of a simple moving average and two standard deviations plotted above and below it. They are commonly used to assess price volatility and detect potential breakouts in XAUUSD.

Effectiveness in XAUUSD Trading: Bollinger Bands are effective in capturing XAUUSD’s price fluctuations, as they expand and contract with changes in volatility. When the price approaches the upper band, it suggests overbought conditions, and when it nears the lower band, it indicates oversold conditions.

User Insights: Traders frequently combine Bollinger Bands with other indicators, such as RSI, to confirm trade signals. Many traders find Bollinger Bands useful for spotting breakout opportunities and setting stop-loss levels based on the width of the bands.

4. Fibonacci Retracement Levels

Fibonacci retracement levels are widely used to identify potential reversal points in a trend. They are calculated using Fibonacci ratios, with levels at 23.6%, 38.2%, 50%, and 61.8% to mark areas where the price might retrace before continuing in the direction of the trend.

Application in XAUUSD: Fibonacci retracement is commonly used to identify support and resistance levels for XAUUSD. In an uptrend, the price may pull back to one of the Fibonacci levels before resuming its upward movement, making these levels valuable for entry and exit planning.

User Feedback: Traders find Fibonacci retracement levels to be precise for establishing critical support and resistance zones, which are crucial in XAUUSD’s high-volatility market. This indicator is often combined with other trend indicators to improve timing and minimize risks.

5. Average True Range (ATR)

The ATR is a volatility indicator that measures the average range of price movement over a specified period, providing insights into market volatility rather than price direction.

Relevance to XAUUSD: ATR is useful for setting stop-loss levels in XAUUSD trading, as it adjusts to the asset’s volatility. During times of heightened volatility, traders may widen stop-loss levels, while tighter stops may be appropriate during periods of low volatility.

Trader Insights: Many traders report that ATR is essential for managing risk in XAUUSD trades, especially during volatile economic events. By helping to set appropriate stop-loss levels, ATR aids in managing exposure and aligning with price swings.

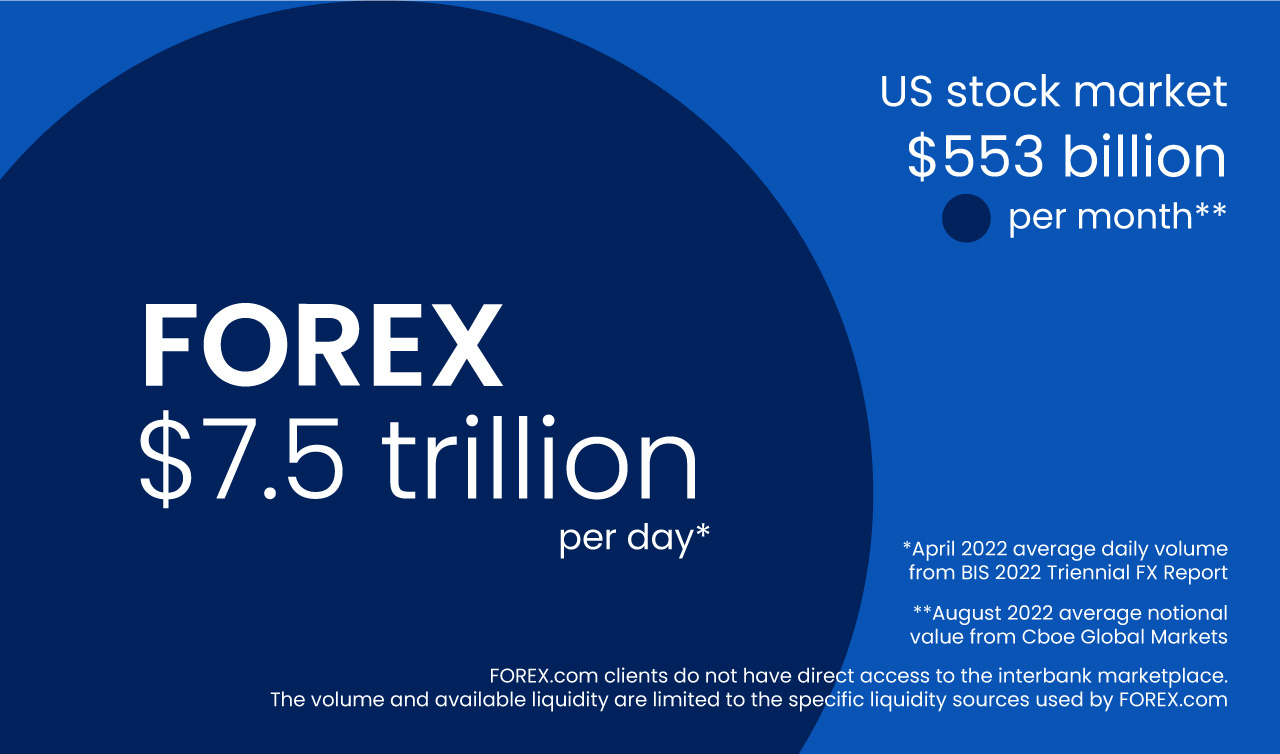

Industry Trends: Increasing Popularity of Technical Indicators in XAUUSD Trading

The popularity of technical indicators in XAUUSD trading has grown due to the ease of access provided by trading platforms like MetaTrader and TradingView. These platforms allow traders to customize and combine indicators, facilitating more strategic decision-making. According to recent industry data, the use of indicators such as RSI, MACD, and Fibonacci retracement has risen by 22% among XAUUSD traders, driven by the demand for tools that can enhance precision in high-volatility markets like gold.

Case Study: Combining Indicators for Improved Performance

Experienced traders often combine indicators to improve signal reliability. For instance, a trader using Bollinger Bands with RSI observed that when XAUUSD prices neared the upper Bollinger Band while the RSI indicated overbought conditions (over 70), the likelihood of a reversal increased. This combination allowed the trader to enter short positions with greater confidence, reducing the chances of false entries. Such combinations underscore the value of using multiple indicators to validate trading signals.

Conclusion

The best indicators for trading XAUUSD—such as RSI, MACD, Bollinger Bands, Fibonacci retracement, and ATR—offer insights into trend direction, volatility, and potential reversal points. Each indicator brings unique strengths to gold trading, helping traders navigate the XAUUSD market with increased precision. By using these indicators individually or in combination, traders can improve their strategy and make more informed decisions, achieving consistency in XAUUSD trading. These tools are essential for understanding and reacting to gold’s unique price movements, providing traders with a robust foundation for navigating this valuable commodity pair.

Discover new trading opportunities with our trusted free forex signals!